Common Stock Dividend Distributable Use Which Par Value

Credit Common Stock Dividend Distributable 20440 Common Stock2 Par Value 20440 Issued 14 stock dividend. It declares a 10 stock dividend.

Chapter14 Corporations Dividends Retained Earnings And Income Reporting Ppt Download

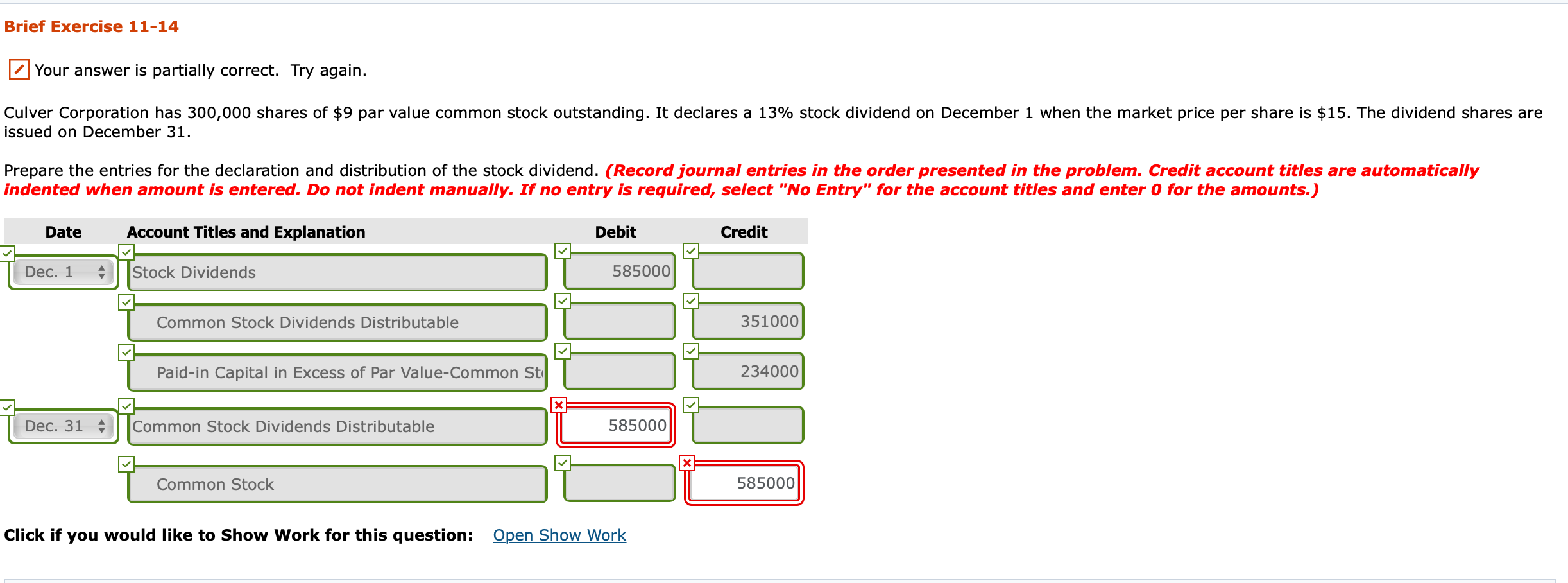

A stock dividend is considered a small stock dividend if the number of shares being issued is less than 25.

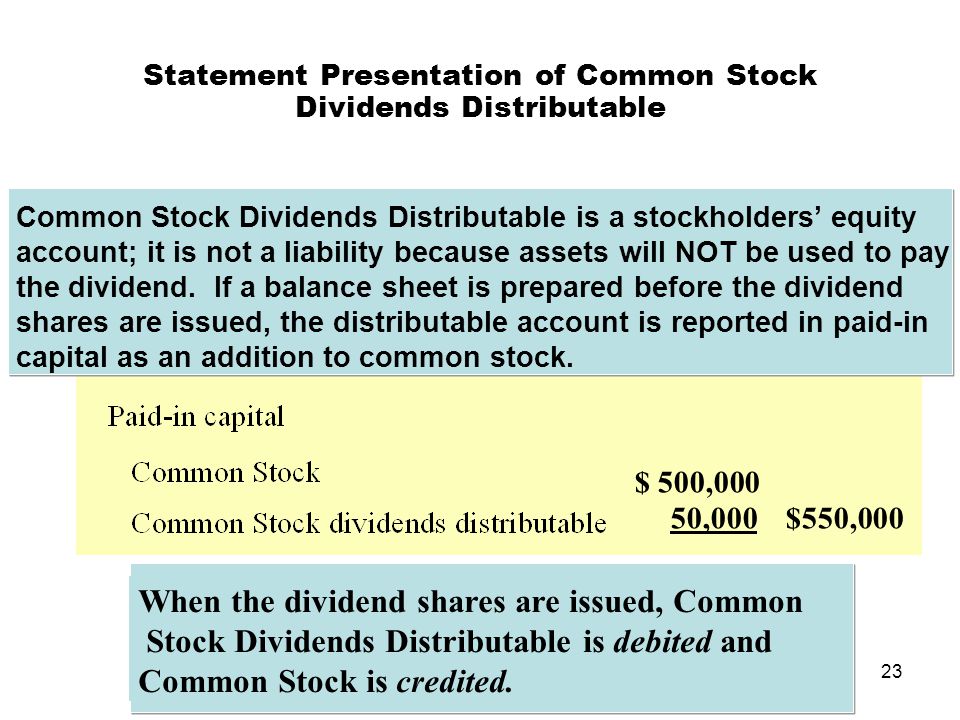

. Since a stock dividend distributable is not to be paid with assets it is not a liability. Paid-in capital in excess of par from stock dividend distributable. After a 2-for-1 split the par value will be 050 per share and there are 200000 shares outstanding with a total par value of 100000.

100 Paid-in capital in excess of par from stock dividend distributable. Epic declares a 19 stock dividend on July 1 when the stocks market value is 22 per share. For example the common stock of Microsoft has a par value of 000000625 per share and Fords common stock has a par value of 001 per share.

Value of common stock at which time it can be converted into common stock. Par value of shares to be distributed 40000 shares x 1 40000 7. Fair market value of shares to be distributed 40000 shares x 9 360000 6.

Record debits first then credits. 1000 Stock dividend distributable. For example assume a company holds 5000 common shares outstanding and declares a 5 common stock dividend.

Presentation of par value stock in balance sheet A company must report the par value of its total subscribed and outstanding shares in its annual financial statements. A memo entry is made to indicate that the split occurred and that the par value per share has changed from 100 per share to 050 per share. The Layline Corporation will make this journal entry to record the transaction of June 30 c.

The stock dividend is distributed on July 20. Hence the value of stock dividend is 250000 500000 x 10 x 5. Journalize the declaration and payment of the cash dividend.

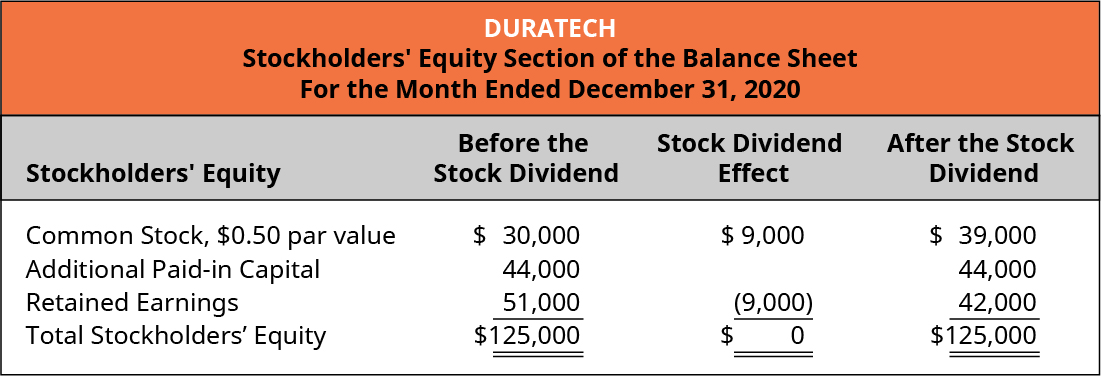

Retained earnings is reduced by 800 to reflect the market value of the 100 shares distributable as all dividends come out of retained earnings even stock dividends. In stock dividend there is no cash which is being involved what is there is. Rather it is the distribution of more.

Read more of the stocks is 10 per share. Likewise the common stock dividend distributable is 50000 500000 x 10 x 1 as the common stock has a. As the company has declared a 10 stock dividend it would be accounted just like a.

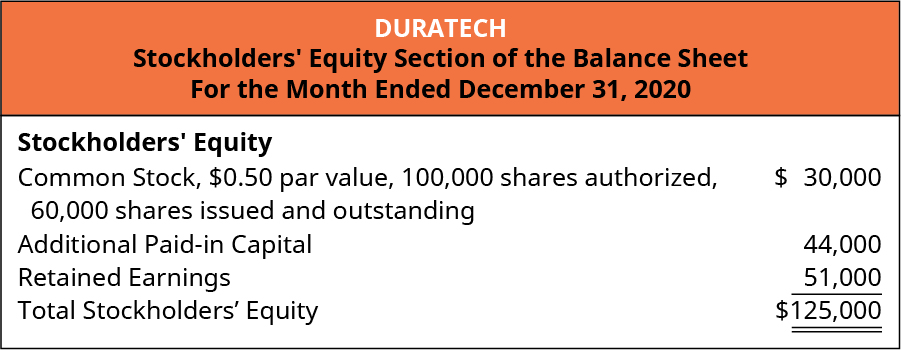

Common stock10 par value 150000 shares authorized 60000 shares issued and outstanding 600000 Paid-in capital in excess of par value common stock 425000 Retained. Increase in common stock dividends distributable equity. A quick look at the balance sheet tells us that the stocks par value is 001 per share so the stock dividend distributable that the company will.

The standard par value for stock is 001. June 17 15 stock dividend to stockholders 24000 160000 x 15. Enables a preferred stockholder to accumulate dividends until they equal the par value.

Total paid-in capital. But on the date of declaration the stock sells at 50share. Accounting questions and answers.

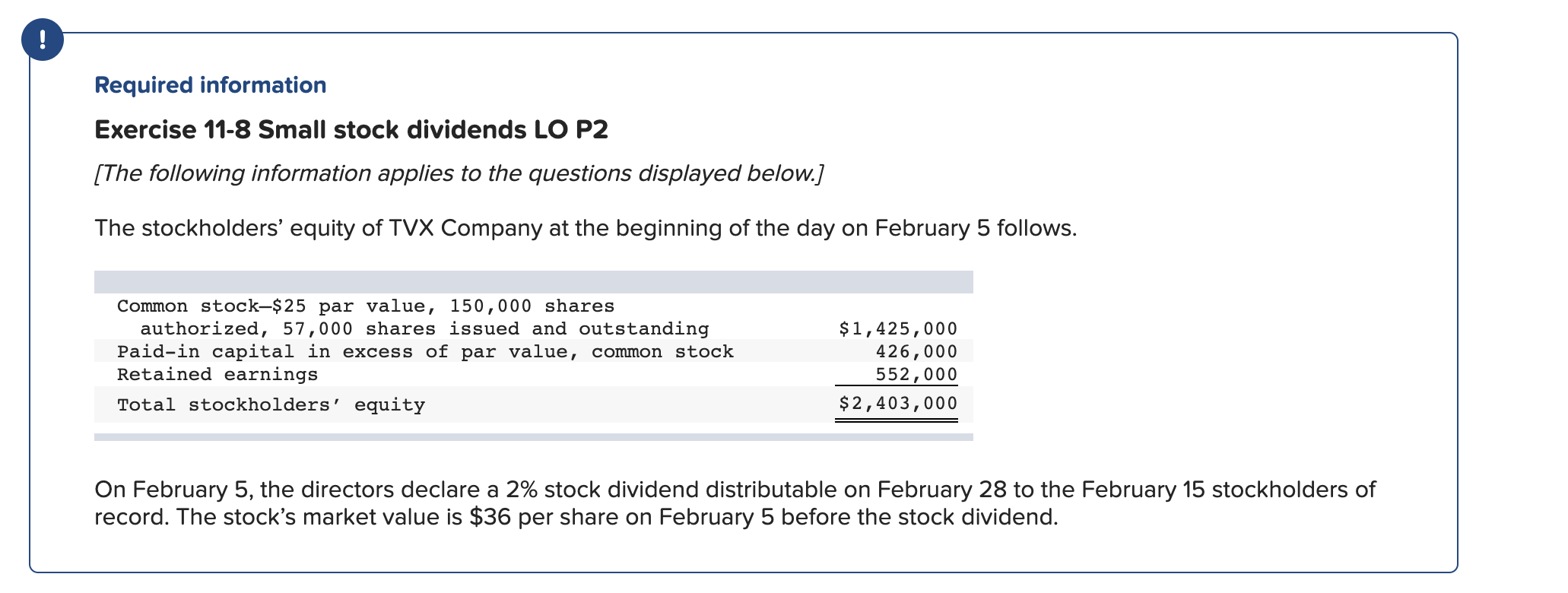

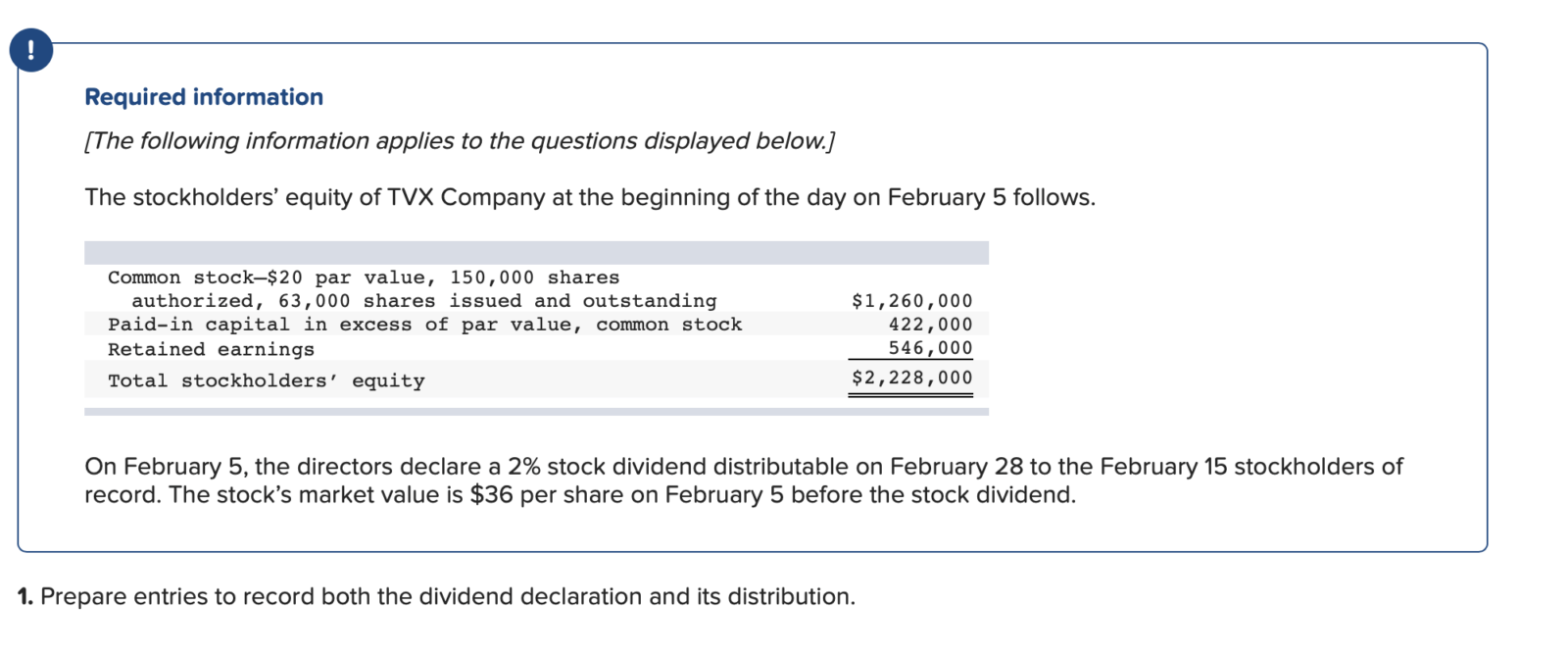

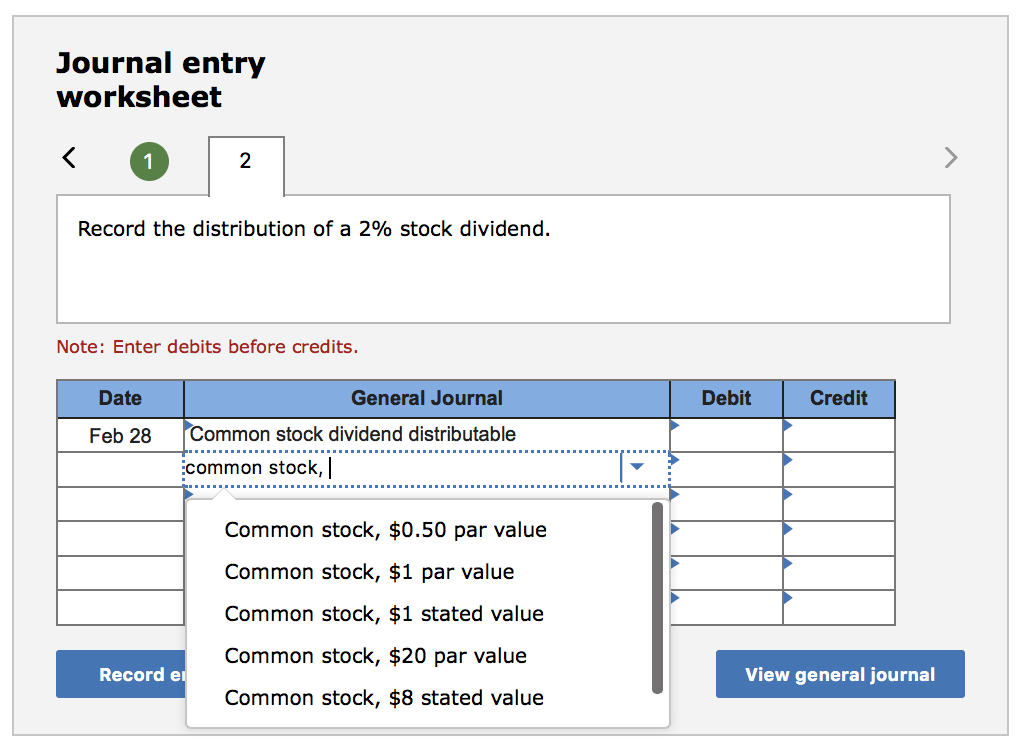

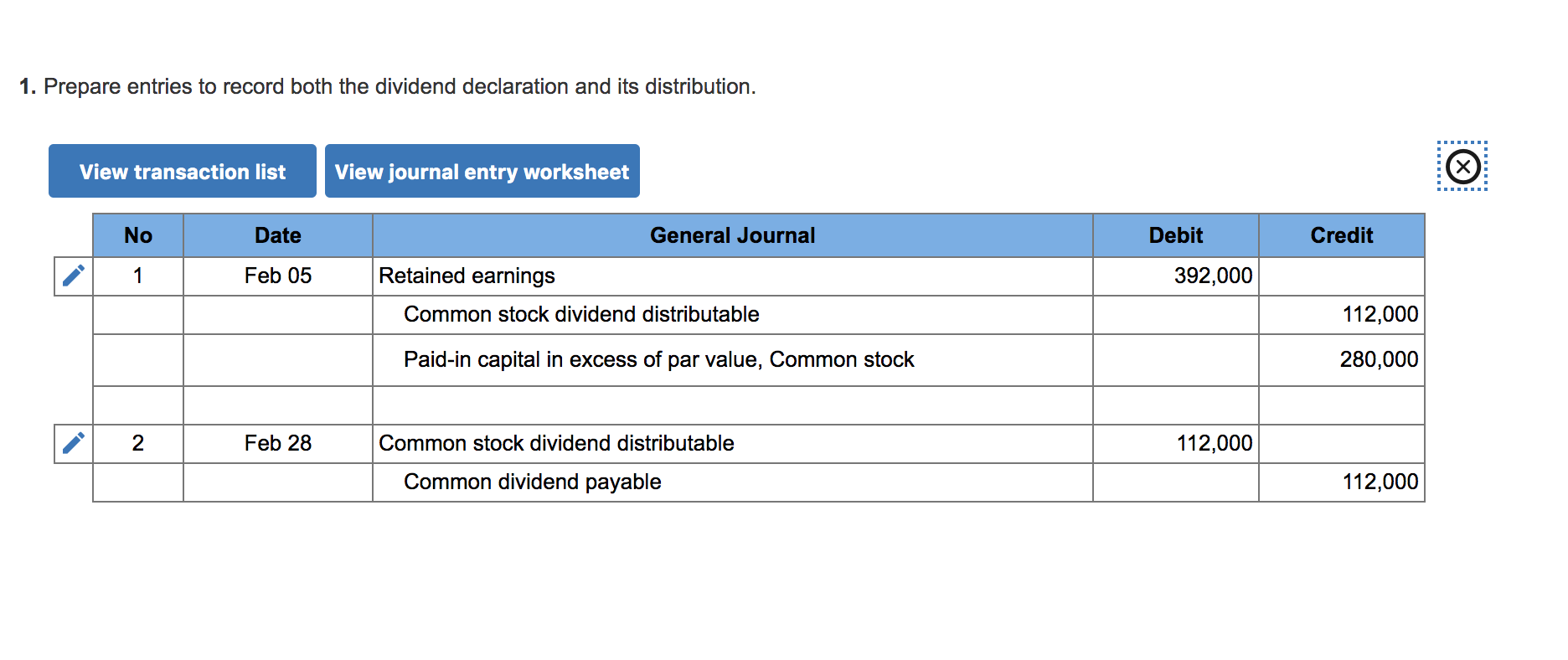

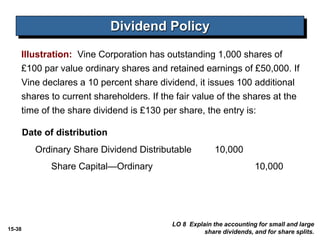

When a company declares a dividend in the form of common stock it takes the market value of the shares to be distributed and places that amount in a special stockholders equity account called common stock dividend distributable. The stockholders equity of TVX Company at the beginning of the day on February 5 follows. Between the time of the companys declaration and the actual issuing of dividends the company would list 7500 as.

Record the declaration and payment of the stock dividend using journal entries. Common stock par value 1 1000 shares outstanding. 19000 240000 Date Accounts and Explanation Debit Credit Oct.

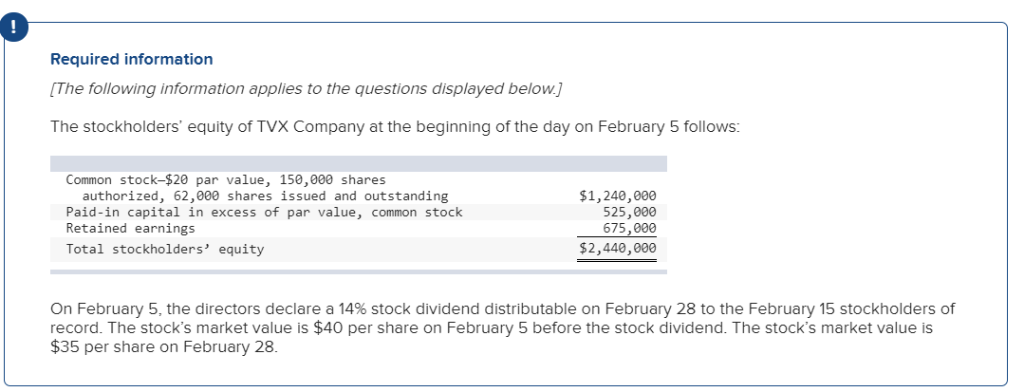

Credit Common stock dividend distributable 120000 Credit Paid-in capital in excess of par value common stock 360000 On February 5 the directors declare a 20 stock dividend distributable on February 28 to the February 15 stockholders of record. Select the explanation on the last line of the journal entry table. Common stock par value 1 1000 shares outstanding.

This is the amount of stock dividends that will be issued to stock holders. Increase in additional paid-in capital equity. Common stock-15 par value 150000 shares authorized 65000 shares issued and outstanding 975000 Paid-in capital in excess of par value common stock 428000 Retained earnings 554000 Total stockholders equity 1957000 On February 5 the directors declare a 2 stock dividend distributable on February 28 to the February 15 stockholders of.

The par value Par Value Par value is the minimum value of a security set and stated in the corporate charter or its certificate by the issuer when issued for the first time. Common stock credit where the dividends are distributed number of shares par value. Means that the shareholder can accumulate preferred stock until it is equal to the par.

The correct answer is C. Multiply the product from Step 2 by the par value of the stock. Outstanding shares Common Stock on January 1 160000 shares.

For instance 90 Degree Corp holds 10000 common stocks. The company declares and issues a 20 dividend. Debit retained earnings market value number of shares.

A stock dividend does not involve cash. In addition the par value per stock is 1 and the market value is 10 on the declaration date. At the same time it reduces retained earnings by an equal amount.

In this example you would multiply 001 times 750000 to get 7500. Credit paid in capital in excess of par stock dividend market value - par value number of shares. The common stock dividend distributable account is a stockholders equity paid-in capital account credited for the par or stated value of the shares distributable when recording the declaration of a stock dividend until the stock is issued to shareholders.

Debit to Common Stock Dividends Distributable for 240000. Issued shares of preferred stock for per share. A common stock dividend distributable appears in the shareholders equity section of a balance sheet whereas retained earnings balance sheet cash dividends distributable appear in the liabilities.

Issued shares of common stock for a building with a market value of. QS 11-7 Algo Accounting for small stock dividends LO P2 Epic Incorporated has 11400 shares of 2 par value common stock outstanding. Number of shares to be distributed 800000 shares x 5 40000 shares 5.

The market price per share of common stock was 15 on the date of declaration. Par value 10. Dividends are distributed to common shareholders.

2 Building 240000 Common Stock 4 Par Value 76000 Paid - In Capital in Excess of ParCommon 164000 Issued common stock for building. A company has 200000 outstanding shares of common stock of 10 par value.

Chapter 15 Stockholders Equity Intermediate Accounting 13 Th

Solved Required Information Exercise 11 8 Small Stock Chegg Com

Corporations Dividends Retained Earnings And Income Reporting Ppt Video Online Download

Corporations Dividends Retained Earnings And Income Reporting Ppt Download

11 Reporting And Analyzing Stockholders Equity Ppt Download

Common Stock No Par 2 Stated Value 380 600 Shares Authorized 281 100 Shares Issued 562 200 Common Stock Dividends Distributable 33 680 Paid In Capital In Excess Of Stated Value Common Stock 1 Study Com

Accounting Q And A Ex 13 10 Entries For Stock Dividends

Corporations Dividends Retained Earnings And Income Reporting Ppt Download

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Solved On February 5 The Directors Declare A 14 Stock Chegg Com

Common Inventory Dividend Distributable Accountingtools Personal Accounting

Stock Splits And Stock Dividends Accountingcoach

Solved Required Information The Following Information Chegg Com

Solved Brief Exercise 11 14 Your Answer Is Partially Chegg Com

Solved The Following Information Applies To The Questions Chegg Com

Cash Dividends Involve Three Events On The Date Of Declaration The Directors Bind The Company To Pay The Dividen Homeworklib

5 10 Dividends Financial And Managerial Accounting

John Wiley Sons Inc C 2005 Chapter 15 Corporations Dividends Retained Earnings And Income Reporting Accounting Principles 7 Th Edition Weygandt Ppt Download

Comments

Post a Comment